AFG takes home two categories in the 2025 WeMoney Awards

From Left: Hayden Cush, General Manager – AFG Home Loans & Matthew Ikin, Executive General Manager – We Money AFG

Your single stop for broker technology. We’ve combined the full suite of tools and technology that brokers need to succeed.

Your essential mortgage broker software for deal lodgement, customer management and product selection.

Drive more leads, referrals and repeat business with our multi-award winning AFG SMART program.

Gain an in-depth understanding of your business with expert reporting and dashboards.

Open the book on AFG and find out how we can partner with you to grow your business.

Discover everything you need to know in our eBook to take the leap and become a self-employed Mortgage Broker.

We’ll apply our experience from working with thousands of brokers to help you achieve your goals.

Access the training you need when you need it with hundreds of learning pathways, webinars and training events.

Masterclasses, conferences, development days, training opportunities, awards and dinners… our calendar is full.

We’ve got the right support to assist you in meeting your compliance obligations.

Offer your customers exclusive access to AFG Home Loans with product options from four lenders.

With over 80 lenders across residential, commercial and personal finance, we’ve got options for all your customer’s needs.

From Left: Hayden Cush, General Manager – AFG Home Loans & Matthew Ikin, Executive General Manager – We Money AFG

AFG delivers positive earnings growth driven by record volumes across the business in an expanding market. Financial highlights AFG Chief

Learn how to get your start as a Mortgage Broker with expert guidance and tips.

Manage your efficiency, keep your business safe and push your growth to new heights.

Take your business from good to great by implementing processes that save time, save money and deliver better customer experiences.

Open the book on AFG and find out how we can partner with you to grow your business.

Dive into our downloadable ebooks for in-depth insights on the latest opportunities.

Immerse yourself in video content from industry experts and leading brokers.

Learn the strategies and tactics used by some of Australia’s top brokers.

Our collection of 20+ calculators are designed to help you plan your financial situation.

See how we support the communities where our customers live and work

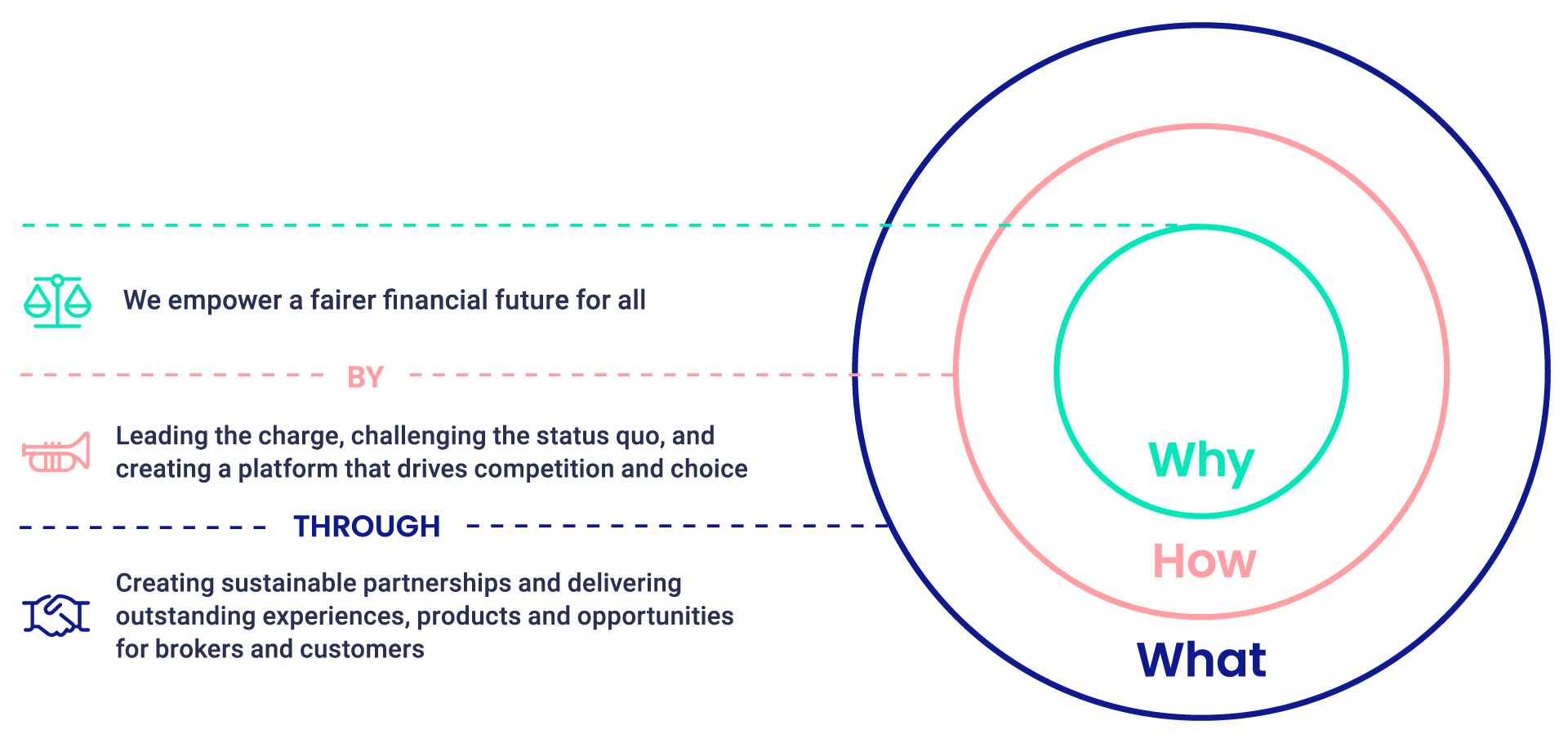

We exist to create competition and financial choice for Australians by protecting and backing the broker industry.

Access our Investor Centre for AFG investor information, including reports, announcements and more.

Download and read the latest AFG investor reports.

AFG was established in 1994 and has grown to become one of Australia’s largest mortgage broking groups and leaders in financial solutions.

Our founders saw an opportunity for mortgage brokers to provide a better solution for Australians’ finance needs. So, 30 years ago, they founded AFG and helped to create an industry.

Today, we’re just as passionate about brokers and the industry. We believe in our community of brokers, no matter how big or small. Australians trust their brokers with their biggest assets, and in turn, our brokers trust us with theirs.

When our brokers grow, we grow. Together, our brokers have built robust, secure, and successful businesses over the decades. We’re proud of that legacy, and it’s also a big part of why we’re now one of Australia’s most secure and prosperous mortgage aggregators.

But we’re even prouder of what those awards represent: our commitment to our brokers, their business and their customers.

The personal expertise you offer your customers is what sets brokers apart in the market and it’s what is leading the shift in how Australians secure their finance. Your customers know that having your expertise in their corner, guiding, and helping them at every turn is priceless. We’re here to surround your business with that same level of expertise.

We know that great experiences start with great people and our promise to you is that we’ll surround your business with over 300 experts who are focused on helping you support your customers, protect your business, and grow to new heights.

We’re all in on brokers. That means we’ll be right here to champion you as you lead the future of broking.

We’ve been through just about every challenge that a business can face in the past 30 years and, together with our brokers, we’ve come out the other side not only stronger but as leaders of our industry.

We partner with over 4,000 passionate brokers nationally and help them offer their customers an unprecedented choice from over 80 lenders across more than 10,000 individual finance products. Last year our brokers supported Australians to secure over $55B in residential finance.

Whatever opportunities the future holds, we’ll be right here providing you with the lift you need to reach them.

We exist to create competition and financial choice for Australians by protecting, backing and championing the broker industry on behalf of our members. We do this through our values.

We do the right thing and hold ourselves and each other to the highest standard. We are known and respected for our commitment to honesty, trust, and transparency.

We take ownership of our actions, behaviours, performance and decisions. We act with consistency, and we keep our commitments.

We earn our customers’ trust by working in partnership with them to create solutions and deliver exceptional customer experiences. We listen, learn, and put our customers at the centre of all we do.

We empower and support those around us to achieve our shared purpose. We collaborate, we challenge ourselves and each other, and we’re open, encouraging, and respectful of everyone we work with.

We have a strong relationship with all our home loan and business lenders and these continue to grow each year.

Offer your customers the choice they’re searching for with over 80 lenders and partners across residential, commercial, asset finance and personal finance.

We are, and have always been, focused on driving value for our investors and creating a positive impact for our employees, brokers, customers, and the communities in which we operate.

Find out more about the different sustainability initiatives at AFG.

Open the book on AFG and find out how we can partner with you to grow your business.

From Left: Hayden Cush, General Manager – AFG Home Loans & Matthew Ikin, Executive General Manager – We Money AFG

Learn why creating repeatable customer experiences could be your biggest revenue growth opportunity.

Find out how we’ve been helping Australians find a fairer deal for over 27 years.