Cybersecurity in 2025: Why Protecting Your Business Is No Longer ‘Optional’

In an age where digital tools drive almost every part of business, cyber threats are rising faster than ever and

Your single stop for broker technology. We’ve combined the full suite of tools and technology that brokers need to succeed.

Your essential mortgage broker software for deal lodgement, customer management and product selection.

Drive more leads, referrals and repeat business with our multi-award winning AFG SMART program.

Gain an in-depth understanding of your business with expert reporting and dashboards.

Open the book on AFG and find out how we can partner with you to grow your business.

Discover everything you need to know in our eBook to take the leap and become a self-employed Mortgage Broker.

We’ll apply our experience from working with thousands of brokers to help you achieve your goals.

Access the training you need when you need it with hundreds of learning pathways, webinars and training events.

Masterclasses, conferences, development days, training opportunities, awards and dinners… our calendar is full.

We’ve got the right support to assist you in meeting your compliance obligations.

Offer your customers exclusive access to AFG Home Loans with product options from four lenders.

With over 80 lenders across residential, commercial and personal finance, we’ve got options for all your customer’s needs.

In an age where digital tools drive almost every part of business, cyber threats are rising faster than ever and

From Left: Hayden Cush, General Manager – AFG Home Loans & Matthew Ikin, Executive General Manager – We Money AFG

Learn how to get your start as a Mortgage Broker with expert guidance and tips.

Manage your efficiency, keep your business safe and push your growth to new heights.

Take your business from good to great by implementing processes that save time, save money and deliver better customer experiences.

Open the book on AFG and find out how we can partner with you to grow your business.

Dive into our downloadable ebooks for in-depth insights on the latest opportunities.

Immerse yourself in video content from industry experts and leading brokers.

Learn the strategies and tactics used by some of Australia’s top brokers.

Our collection of 20+ calculators are designed to help you plan your financial situation.

See how we support the communities where our customers live and work

We exist to create competition and financial choice for Australians by protecting and backing the broker industry.

Access our Investor Centre for AFG investor information, including reports, announcements and more.

Download and read the latest AFG investor reports.

BrokerEngine Plus is the mortgage broker software that delivers the experience your customers demand while automating and streamlining your workflow.

Take a peek at the broker platform that’ll help you simplify your day to day and exceed your clients’ expectations, and your own.

Less chasing up clients, more five-star Google reviews.

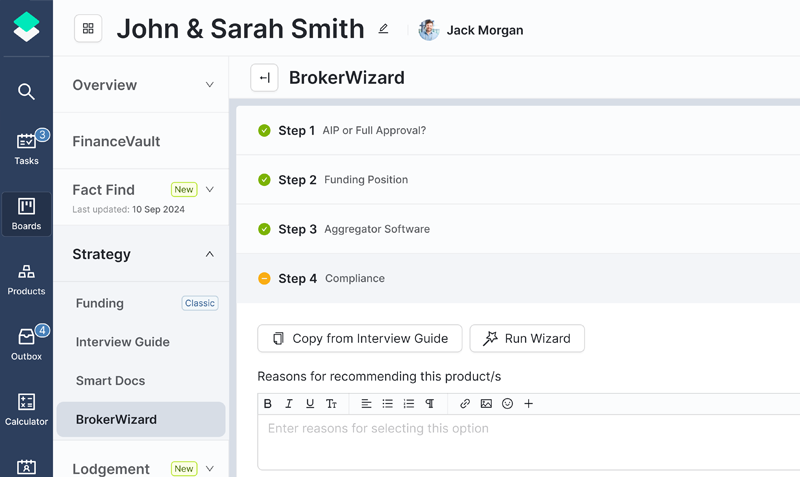

Recommending the right products is just the start; creating an unforgettable experience is what’ll really set you apart. We’ll help you create client experiences that shift-the-dial and generate repeat business.

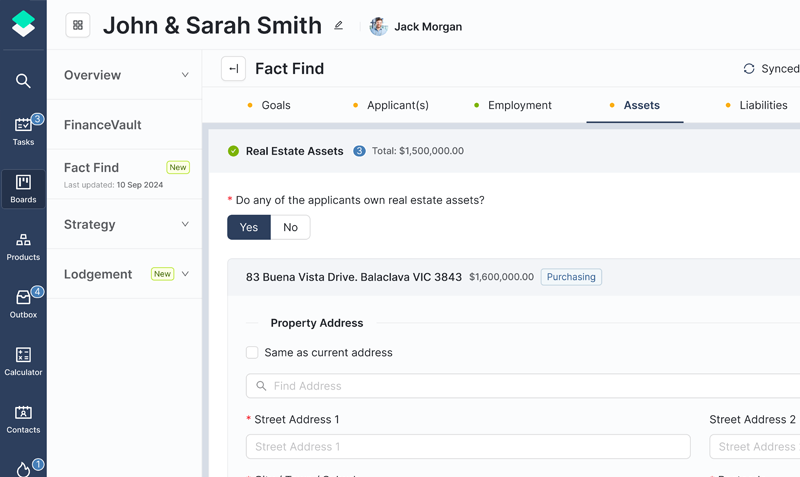

Package and lodge every deal more accurately and faster than ever, with what you need at your fingertips. We’ve got you covered from first customer contact to lodgement to lender, with automation to increase processing speed.

The days of double data entry are over. Save up to 90 minutes per deal with

Prioritise your to do list and reduce errors with

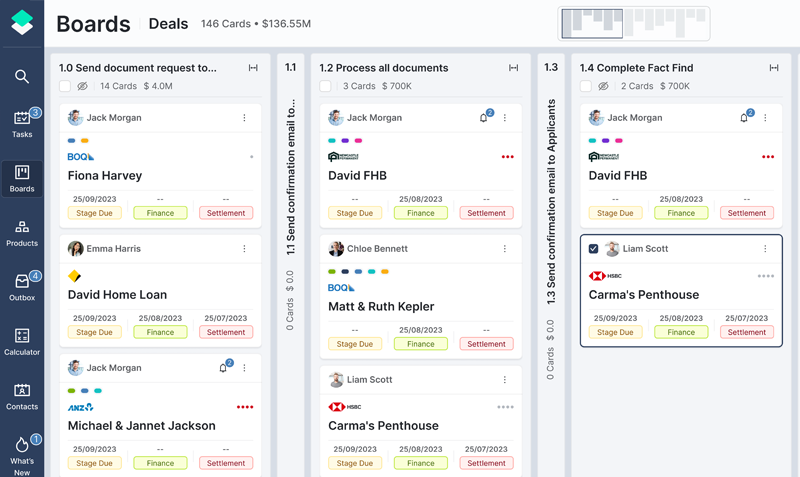

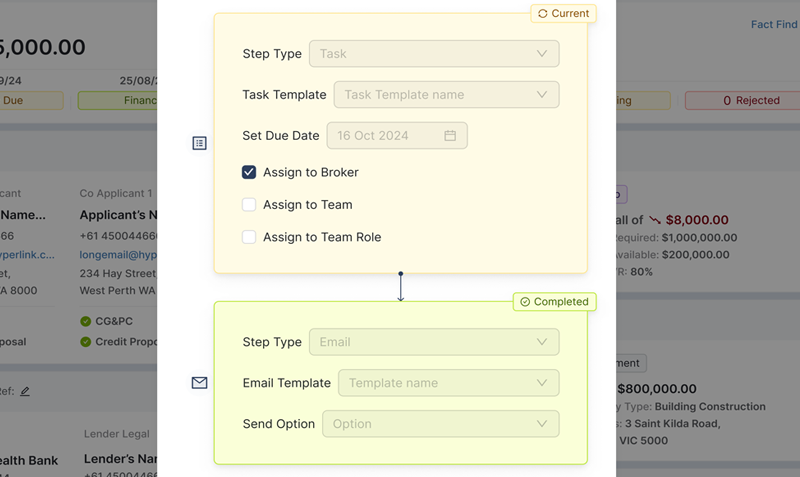

Everything will be alright—the right person, the right task, the right time. Automate and prioritise tasks so you and your team are always on track and know what to do and when. Take a step back, knowing everything is under control.

Achieve your goals faster with a platform that adapts to your business, whether you’re streamlining or expanding. Used by everyone from individual brokers to large multi-location teams, you can move forward with flexibility and confidence.

Start with our

BrokerEngine has really transformed our mortgage broking side of the business. It’s streamlined our workflow and made managing client documents a breeze with the document vault. Overall, BrokerEngine has helped us grow our business while still providing great service, and we can’t imagine working without it!

Direct lodgement to ApplyOnline makes the lodgement process easier than ever.

Collect supporting documents using one link to save time on every deal.

Build loan scenarios and compare products in minutes with our loan comparison tool.

Automate email sends and assigning tasks with out of the box workflows that you can customise when you’re ready.

Draft, edit and send workflow emails all from your own email domain (works with Office365 and Google Workspace).

Integrated Credit Guide, Privacy Consent and Credit Proposal to wave goodbye to wet signatures.

Every deal is automatically matched with a customisable checklist, reducing errors and shortening processing times.

The smart task queue provides a real-time to do list that manages priorities and maximises output.

View all your deals in one place so you can prioritise the “at risk” deals early.

See how your future settlements are tracking, so you can act now to move the needle.

Open the book on AFG and find out how we can partner with you to grow your business.

In an age where digital tools drive almost every part of business, cyber threats are rising faster than ever and

Learn why creating repeatable customer experiences could be your biggest revenue growth opportunity.

Find out how we’ve been helping Australians find a fairer deal for over 27 years.