Many mortage brokers talk a good game when it comes to being customer-centric, but often it’s just that.

CX (which stands for Customer Experience) isn’t a fad, it just has a new moniker. It’s here to stay, and it could be the biggest revenue lever for brokers who are wanting to grow their business.

Explaining CX

In the broadest terms, CX refers to the interaction between you and your customer over the duration of your relationship.

CX is a catalyst for the redesign of customer processes and interactions to increase customer loyalty, improve relationships and create true advocates of your mortgage broker business.

Why is CX so important?

CX is the space where you can demonstrate a real advantage over your competitors.

The size of the prize for a mortgage broker business is big, when you’re looking to:

- attract, convert and retain better customers,

- reduce costs,

- reduce churn

- and increase efficiency.

If you’re looking to lead the way in our industry when it comes to market intel and innovation, be more responsive to the needs of tomorrow’s customers, or better anticipate business trends and customer behaviours, then CX will be your best friend.

Remember, it’s your job to give your clients the best CX they can. You want to give them more and more reasons to keep coming back!

Want to make data informed decisions when it comes to your customers?

It’s time to say goodbye to guesswork and hello to Analytics. Find out how you can start making data informed decisions.

When good service is not enough

Your customers may not be coming back as much as you think they are.

The reason this is so surprising to many brokers is that your experience would lead you to think otherwise. They give you 5-star Google reviews and complete positive customer satisfaction surveys that praise you for your service. However, good service is likely not enough to ensure repeat business or drive referrals.

Good service is just the minimum benchmark. It means you have met your customers’ expectations. But here’s the kicker: this is the experience that customers expect from all brokers. It is also the reason that they will just as easily go elsewhere.

The benchmark to drive better repeat business and referrals is about exceeding expectations and ideally, creating customer advocates.

Map your customer experience journey

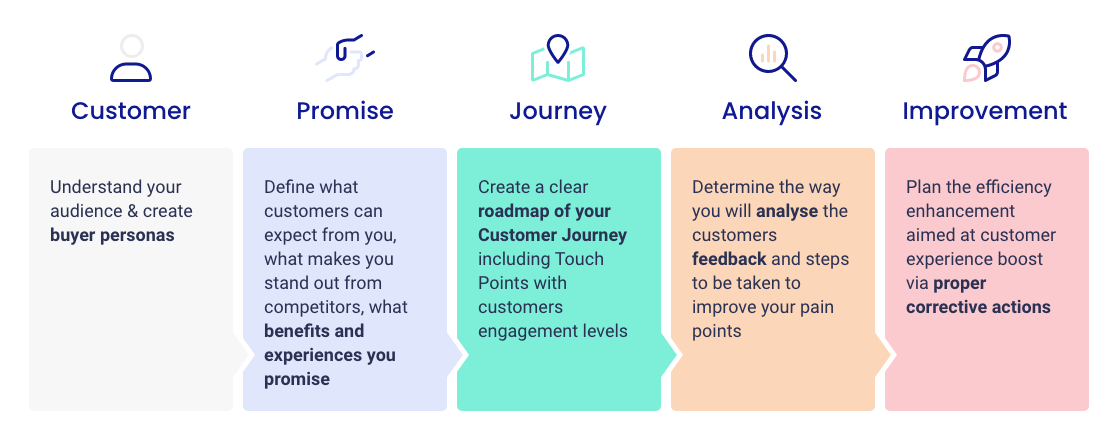

The above diagram lays out what a basic customer journey mapping process might look like.

For example, if you look at the customer segment of the journey, think about how your service and support might change depending on which customer you are helping. For example, a first home buyer needs a slightly different experience than an investor. They may need more information, explanations of terms and more of your time to build up trust and confidence. On the other hand, an investor wants a faster outcome without all the extra time and explanation.

Finding a middle ground and offering both these audiences the same experience means that one could get too much information and the other not enough and both customers end up with an average experience. It’s a simple example which highlights the need to understand and plan a slightly different experience for distinct types of customers.

By identifying different audiences (personas), mapping their experiences and designing different experiences for each group, you are taking the first step to building highly satisfied customers.

Have a plan to delight your customers

Just like the hand-written note from your eBay seller or your favourite fruit in your hotel room, finding ways to delight and surprise your customers is one way to stand out and create a memorable and genuine experience above the day-to-day business of mortgage broking.

Finding something that’s unique is always better but here are a few to get you started:

- Settlement gifts

- Personalised videos

- Remembering personal details when you meet for a second time

- Out of the box ideas to help you stand out

How SMART can help you improve your CX

With AFG’s multi-award-winning SMART platform, you’ll be able to easily stay connected with your customers.

SMART is our Marketing Automation platform that has been built our customer experience milestones. SMART can automate keeping track of your customers and help you deliver serendipitous communications at the perfect moment in your customer journey. Discover how SMART can save you time, money and help you connect with your customers.