As a mortgage broker, it is important to keep on top of all areas of your business, while also planning ahead for the future. As the old saying goes, failing to plan is planning to fail.

Having a business plan helps brokers to take the reins of their business and enables them to set a sense of direction for their business.

Here is how you can build a robust plan for your business.

Manage those bumps in the road

A business plan is a description of your business and its future. It documents what you plan to do and when you plan to do it, helping you to set realistic goals for your business.

Analysing you and your business can help you to anticipate any challenges you may face and help you overcome them.

It also helps you to think more strategically, by laying out a plan for a point in the future (usually the next three to five years), by which time your business will most likely have a different set of resources, as well as greater profitability and increased assets.

Why have a business plan as a mortgage broker?

- Helps you prioritise

- Gives you control over your business

- It is vital to help you with your own finances

- Helps you establish your business focus

- Attracts potential business partners to help you grow your business

What to include in your business plan:

1. Your mission statement

This is your why. Here is where you articulate why your broker business exists and what you aim to achieve. You should spend the time to think about your values and principles that guide your business and write these into your business plan.

2. Your value proposition

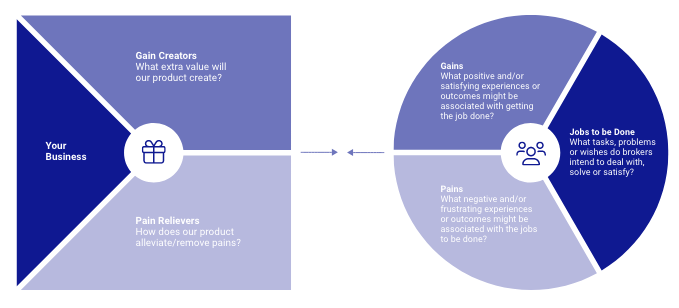

A great value proposition helps your customers understand the benefits of choosing your business. An effective way to think about your value proposition is to think about it in terms of a value proposition map that breaks down the customer jobs, customer pains, customer gains and then pairs these with your products and services to see how your business can create customer gains and relieve customer pains.

3. Market Analysis

Get to know the Australian mortgage broking industry and market. This can include things like market size, customer segments, lending trends and other growth opportunities. You should gain a clear understanding of your current customers, what segments they belong to, their characteristics and any patterns you can identify.

As an AFG broker, you can make data-informed business decisions with AFG Analytics using easy-to-use dashboards and reports to identify trends in the market, understand your customers, break down your performance metrics and gain a clear understanding of your portfolio and the wider Australian market.

4. Target audience

You can define your target market based on factors such as demographics, income levels, geographic location and financial needs. The important thing to consider is whatever segmentation of the market you decide to target aligns with your experience and specialisation. Evaluate your own knowledge, skills and experience in the industry, for example, you might have expertise in first-homebuyers or investment properties – whatever your niche, make sure you have the specialist knowledge to back it up.

5. Branding and Positioning

When designing your brand think about how you are positioning your business in the mind of your customers. What do you want them to think about you? Are you looking to convey yourself as professional and trustworthy? Or maybe friendly and efficient? Remember you can’t be all things to all people, it’s best to be decisive and occupy a clear position than to spread yourself too thin and have nothing that distinguishes you.

Once you’ve come up with your logo, colours and visual identity, remember that consistency is key! Keep an eye on all your marketing going out the door to ensure that it is on brand and consistent at all times.

6. Digital Presence

Your digital presence is very likely the first thing your customers will see. Ensure that your website is both professional and functional. Your website is where you can showcase your services, build trust with potential customers and start to generate leads.

If you want to simplify setting up your digital presence, AFG brokers have access to our SMART marketing program. SMART will not only provide you with a professional website that you can customise to your brand, but it will also provide lead magnets to drive leads, and it will also give you a comprehensive range of customer email campaigns that manage your new customers, loan life-cycle communications and customer retention.

How are you going to market your business?

AFG’s multi-award-winning SMART platform is designed for brokers who want to see their business soar. Find out more about SMART.

7. Lead Generation

Outline exactly how you’re going to attract leads and potential new clients to your business. There are several different strategies you can employ to drive leads and new clients, such as developing a referral agreement with a real estate agent, financial planner, accountant or other professionals, optimizing your website for Google, content marketing, using lead magnets on your website to capture customer contact details, encouraging referrals from your customers.

Looking to set up a referral network? Check out our guide to Building Profitable Referral Networks.

In your business plan, it’s a great idea to answer questions about your company structure, who you may have in mind to take over your business, whether you’ll consider selling your business, and what will happen to your staff and brokers.

– Donna Cooper, AFG Support Manager

8. Operations and Management

Detail your business operations, including your physical location, technology infrastructure, and key equipment or software. Outline what your technology stack looks like, what do you need to be efficient and what the costs are involved. You will also want to provide an overview of who will be working in your business and what their roles and responsibilities will be. Unsure of how you want to structure the people strategy of your business? You may want to consider a Strategic Workforce Plan.

9. Product and Service offering

Detail the mortgage broking services you offer, including loan types that you specialise in, which lenders you are accredited with – detail how these lenders align with your target audience and specialisations. Highlight any additional services, such as commercial finance, personal loans, or asset finance that you provide to add value for your clients.

10. Financial Projections

Include financial forecasts for the next three to five years, including projected revenue, expenses, and profitability. Provide a breakdown of the sources of revenue, such as commissions or fees, and any anticipated growth rates. Include a budget, cash flow statement, and balance sheet. This section should also address any funding requirements or investment opportunities.

11. Risk Management

Identify the potential risks and challenges that your mortgage broking business may face. Discuss strategies to mitigate these risks, such as having proper compliance procedures in place, staying updated with regulatory changes, or having a backup plan in case of economic downturns. Address cybersecurity risks and data protection measures.

12. Implementation Plan

Outline the steps and timeline for implementing your business strategies and achieving your goals. Break down major milestones and assign responsibilities. This section should provide a clear roadmap for the execution of your business plan.

Be a massive SWOT!

A SWOT analysis is a useful strategic planning tool you can use for your business.

SWOT stands for strengths, weaknesses, opportunities, and threats.

Strengths and weaknesses are internal to your business and somewhat within your control and can change. For example, your team, your location and your business partners.

Opportunities and threats are going on outside of your business in the larger market, such as your competitors, new laws that are introduced, or government grants provided to borrowers.

SWOT is a key part of preparing your plan as it’ll help to make everything more realistic.

Pick an aggregator who knows your business

As your business grows, it becomes harder to find peers and advisers to push your growth, teach you new strategies and help take your business to a whole other level.

If your current aggregator isn’t quite hitting the mark, it may be time to accelerate your growth with a switch to AFG.